Topics:

- Disability benefits for expats

- Deregistration IPMI Group Plan - Continuation Options

- Deregistration IPMI Group Plan - Return to Switzerland - Vesting or suspension of benefits

- In your own interest

Disability benefits for expats

Anyone who can no longer work due to an accident or illness expects benefits from the insurance company. What seems to be clear at first glance has many pitfalls.

The term invalidity is still common in Switzerland or in Anglo-Saxon usage (e.g. also part of the CH-IV legislation), but is no longer common (allowed) in German usage, for example. The term "invalidity or even disability" is considered discriminatory.

We nevertheless take the liberty of using the term "disabiliy" as an umbrella term. In order to understand benefits accurately from an insurance perspective, we have to "trouble" a whole vocabulary. We have compiled some relevant terms below. Mind you, this mini-encyclopedia is far from exhaustive. In addition, the same terms are used differently depending on the country/context.

Disability benefits are existential. Therefore, one has to deal with it and look at it very carefully. From a Swiss perspective, we usually assume the best possible definition of disability and partial disability (e.g. according to the BVG/IV). However, this definition is hardly relevant from a global perspective. The benefits are usually much more "limited". For example, a one-time capital sum is insured and not a pension. The lump sum is only paid in the event of an accident or, for example, only in the event of total incapacity for work, but not in the event of partial incapacity for work or even occupational disability.

In an international context (expats), the question often arises as to whether supplementary disability insurance should be taken out locally or whether it is better to insure it "centrally" within the framework of an expatriate contract (offshore). One argument in favour of the expatriate contract is that the conditions are uniform and clear. These can be based on the Swiss system, for example, and are identical for all expats. This means that the conditions remain the same even if the country is changed. The decision whether benefits will be paid by the insurer does not depend on a social security authority. Benefits can usually be paid by the insurer in any country (compliance). However, such solutions usually offer no tax advantages.

|

Non-life insurance (damage insurance) |

The amount of the insurance benefit depends on the financial loss incurred, i.e. e.g. on the "amount of the loss of earnings" |

|

Sum insurance |

The amount of the insurance benefit is a fixed defined sum |

|

Daily allowance |

Salary compensation (often 80%) as a result of a temporary inability to work due to an accident and/or illness. Usually after a waiting period of 30 to 90 days with a duration of up to 2 years |

|

Disability pension |

Pension as a result of accident and/or illness, payable until ordinary retirement age |

|

Disability lump sum |

Lump-sum payment as a result of accident and/or illness |

|

Incapacity for work |

Payment of insurance benefits if no gainful employment can be pursued in the long term (any occupation/activity, i.e. more restrictive definition than in the case of occupational disability). |

|

Inability to work |

Payment of insurance benefits (see daily allowance) if no activity can be carried out |

|

Occupational disability |

Payment of insurance benefits if the original/similar occupation can no longer be exercised in the long term (also an occupation corresponding to the education/experience) |

|

Partial disability |

If insured, a partial pension or a partial lump sum is paid out in the event of reduced disability (e.g. a pension from a degree of disability of 40%) |

|

Disability/dismember-ment scale |

In the event of an accident, the degree of disability and therefore the sum insured is determined according to a fixed scale |

|

Premium waiver |

After a defined period of incapacity for work (often 90 days), the insurer takes over the contributions/premiums to the old-age pension scheme and life cover |

Withdrawal IPMI Group Plan - Continuation Options

Remaining abroad (International Continuation Option)

In case of withdrawal from the IPMI group plan (e.g. due to retirement, change of employer, etc.) and remaining abroad, the question arises as to how the insurance cover should be continued.

In many cases, there is a statutory basic insurance in the country of residence (host country), through which one is more or less well insured locally. However, the international cover ceases, so that treatment is no longer possible in the home country (e.g. Switzerland).

If international health insurance is still needed/desired (with which optional treatment in the home country is possible), coverage must be sought on the basis of an individual policy.

There is a relatively large selection of international health insurers offering such individual policies. Depending on the country of residence, however, it can be quite difficult to obtain an offer. In addition, there is also a risk assessment here (as with private supplementary insurance in Switzerland), i.e. health questions must be answered. There is thus a risk of exclusion or, in the worst case, rejection.

Therefore, there is a freedom of movement here (we are talking about the International Continuation Option). Depending on the IPMI provider, the insured person can transfer from the group plan to an individual product without risk assessment. This risk-assessment-free transfer is linked to certain conditions (e.g. minimum insurance period in the group plan). In addition, depending on the insurer, the free transfer is structured very differently. Examples:

- Differing high costs for the inclusion of vested benefits by employers.

- Differently high premiums/rates in the individual product

- Limited choice of plan in the individual product

- Limited benefit level in the individual product

- Limited choice of countries (in certain countries the continuation product cannot be offered)

- etc.!

It is not easy to keep track of all this, as the conditions are always changing. Contact us, we will be happy to advise you.

Return to Switzerland (Swiss Continuation Option)

On return to Switzerland, the person is again fully subject to the Swiss health insurance system. In this case, the international health insurance can no longer be continued.

If the insured person wishes more than KVG coverage (e.g. private hospital insurance), he/she can select the desired supplementary insurance product from a health insurance company. It should be noted that a risk assessment is carried out before acceptance (risk of rejection).

In order to solve this problem, certain health insurance companies offer the possibility of suspending their supplementary insurance products prior to the stay abroad (please refer to the text on the subject of suspension below).

In addition, some international health insurers have cooperation agreements with Swiss health insurers that provide for a so-called "free movement regulation". In this case, the insured person is granted a smooth transition (without risk assessment) to certain supplementary products of the partner insurance company when returning to Switzerland. This "vesting" is subject to conditions (such as equivalent prior insurance in Switzerland before moving abroad, age limit, minimum insurance period in the group plan, etc. - the rules vary depending on the provider).

Both the suspension and the vesting rules via the IPMI group plan are interesting for insured persons. However, we would like to point out that these rules can also change during the stay abroad.

We will be happy to explain the details of this free movement issue to you.

Withdrawal IPMI Group Plan - Return to Switzerland - Free movement or suspension

Anyone who leaves Switzerland and is insured by their employer under an IPMI contract must think about their return before they leave!

What options are there to ensure that insurance cover under the supplementary insurance schemes (VVG) can be restored on an equivalent basis on return? The state of health and/or age at the time of return may mean that insurance cover can no longer be taken out under the supplementary insurances. Only the statutory basic insurance pursuant to the KVG remains.

There are two ways to avoid this:

- the international IPMI plan may include a so-called free movement to a Swiss health insurance company. If this is the case, minimum insurance duration and age limits must be observed (see also article Swiss Continuation Option).

- the employee suspends his supplementary insurance when he deregisters in Switzerland. But: Not all health insurers recognise a suspension (VVG products must then either be terminated or continue to be paid at full premiums, possibly without benefits abroad). Or a suspension is possible for a limited period (e.g. 5 years), but may exclude certain risks (e.g. accident during the suspension period is not insured after return) and can be expensive (up to 30% of the normal premiums).

A combination of a) and b) is also conceivable as a solution, i.e. a suspension (if possible) until the minimum insurance period in the IPMI plan is fulfilled.

The perfect solution does not always exist! We are happy to help

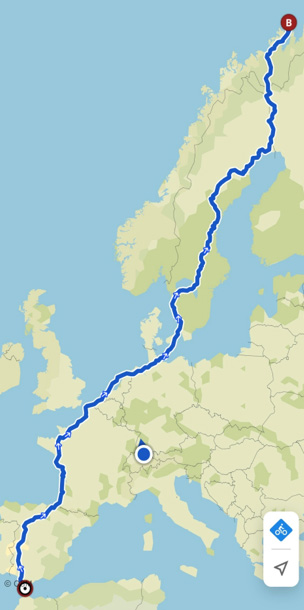

On our own account: Cycling through Europe - from south to north

Ralph is fulfilling a dream from May to July 2022 - travelling through Europe with “sack and pack”, 7300 km. Let's see how far he gets...but the journey is the destination!

You can follow him on Instagram under Ralph_n_Roll