Topics:

I'll be on my way! Insurance cover during my sabbatical

A sabbatical, a break from "normal life", is what many people want. Travelling again or simply spending a few weeks or even months somewhere in the world, unwinding, forgetting the stress, pursuing a hobby......... That sounds tempting. Ideas are quickly born. But how are you supposed to finance it if it's an unpaid holiday? Spending more money but not earning any quickly creates a large "gap". Unfortunately, we can't help with this problem. However, there are also important questions regarding insurance. How am I covered by health insurance, what benefits are insured in the event of death or disability? We are happy to provide support here. An overview:

Health insurance (medical expenses insurance for illness and accidents)

If a person stays abroad for up to 6 months, they will generally not deregister in Switzerland. This means that they remain covered by the statutory KVG health insurance and can take out appropriate cover abroad through their health insurer or travel insurance with a medical expenses supplement (for acute illnesses/emergencies). This is also essential, as the KVG only provides insufficient cover abroad. Taking out supplementary insurance is not a problem if you are healthy. It is less well known that you remain subject to the KVG even if you deregister in Switzerland but do not take up residence abroad, e.g. when travelling around the world. You also have to "assert yourself" vis-à-vis health insurers if you insist on this regulation, as it is often not known.

The situation becomes more difficult if a person is already abroad, e.g. on a posting with continuation of Swiss social insurance. When the posting ends (and the person remains abroad), the KVG cover ends - at best you could refer to the "no residence rule" as mentioned above. However, you also need supplementary insurance benefits (supplementary insurance) and you cannot take out this insurance without being resident in Switzerland (CH health insurance, CH travel insurer). There are no simple solutions here. The employer and the IPMI* insurer may allow you to remain in the international medical expenses plan (if there is one) or you have to try to find cover locally, i.e. in the host country, which is not always easy, especially not for a short period. If the KVG can be continued, accident cover must also be included (unless an interim insurance/Abredeversicherung is taken out, see below).

*IPMI = International Private Medical Insurance = International Medical Expenses Insurance

AHV/IV/EO

As no salary is owed during the period of absence, no social insurance contributions AHV/IV/EO are due. In order to avoid a gap in contributions and thus a possible reduction in the retirement pension, this must be clarified in advance with the relevant compensation office. If the minimum contribution of CHF 514 per calendar year (2024) is not reached with the salary contributions, it may be necessary to register as a "non-employed person/non-working person". The condition is that you must remain resident in Switzerland. If you deregister in Switzerland, you can join the voluntary AVH/IV if certain conditions are met (e.g. host country outside the EU/EFTA). Contributions as a non-employed/non working person are calculated on the basis of the "employee's" assets and any pension income. Subsequent payment of contributions as a non-employed/non working person is possible for a maximum of five years retrospectively - in the case of gainful employment abroad, subsequent payment is not possible.

Unemployment insurance (ALV)

No unemployment insurance contributions are due during unpaid leave, as there is no entitlement to unemployment benefit during this period. The entitlement only arises again after return, provided that contributions to ALV have been paid for at least 12 months within two years.

BVG/Pension fund

Depending on the regulations, various options are conceivable; these must always be agreed with the employer and the pension fund:

- Payment of all employer and employee contributions by the employee. This means that the insurance is continued in full. In this way, you save for old age even during unpaid leave and the risks of death and disability are covered.

Or only the risk contributions continue to be paid so that death and disability benefits are still covered. As a rule, the condition for continuation is the conclusion of an interim insurance policy/Abredeversicherung (see UVG/UVGZ/interim insurance).

- Or you waive a/b with the corresponding consequences. This is definitely not recommended!

In general, a 30-day extension of cover applies for the risks of death and disability.

Pillar 3A

You may only pay into Pillar 3A if you live in Switzerland and earn a salary subject to AHV contributions.

Daily sickness benefits (KTG)

If you are employed and unable to work due to illness, your salary will continue to be paid, first by your employer and then, after the waiting period has expired, by the daily sickness benefits insurer (if insured). In the case of unpaid leave, there is no salary and therefore no loss of earnings, so no benefits are paid by the insurer. Most KTG providers cover loss of earnings in the event of illness during unpaid leave from the time of the planned return to work (this period may be limited in time). It is necessary to check whether sick days during unpaid leave count towards the waiting period. In general, continued payment of salary after return is an important issue that must be discussed with the employer.

If the place of residence remains in Switzerland (LI), a transfer to the KTG individual insurance would also be conceivable. However, this would only make sense in exceptional cases.

Another option is to insure the daily allowance via the health insurer (in addition to KVG/VVG cover). But caution is advised. The principle also applies here that no daily allowance can be paid out without a salary (indemnity insurance). It must therefore be clarified individually with the insurer whether there is an entitlement to benefits from the date of return or not.

UVG/UVGZ/interim insurance (Abredeversicherung)

The UVG has a statutory extension cover of 31 days. The first month would therefore be "covered". After that, you can and should take out interim insurance (Abredeversicherung = AV), which must be taken out by the last day of the extended cover period. It usually costs CHF 40 - 70 per month, depending on the provider! The maximum duration is 6 months. It may be possible to extend this further. The AV covers medical costs (accident) without cost sharing and deductible but within a limited framework (double the amount of the costs in Switzerland analogous to the KVG outside the EU/EFTA) but also travel/transport/rescue costs, daily allowances of 80% from the 3rd day of the last insured earnings as well as pension benefits in the event of death and disability

This cover is definitely worth taking out.

UVG supplementary insurance (UVGZ)

If the employer has supplementary UVG insurance (UVGZ), the cover can also be continued during unpaid leave. UVGZ cover can include various components such as worldwide (private) medical expenses insurance in the event of an accident, daily allowances, pensions or lump sums in the event of death and disability in addition to the UVG. However, the corresponding contractual conditions for unpaid leave must be checked. One possible regulation is as follows:

"Unpaid holidays are co-insured without notification. Insurance cover is granted for a maximum of the duration of the UVG interim insurance (AV) (incl. UVG extension cover). In the absence of UVG interim insurance, there is no insurance cover under the accident insurance supplementing the UVG. The calculation of benefits and premiums is based on the last salary received before the unpaid leave. At the end of the insurance year, the total salary must be taken into account in the declaration and declared as if the employee had not taken unpaid leave."

Personal liability insurance

It also makes sense to continue your personal liability insurance in any case. As long as your place of residence remains in Switzerland, this is not a problem. However, it is advisable to inform the insurer and check whether the insurance cover is valid worldwide. It becomes more difficult if you deregister in Switzerland. In principle, the personal liability insurance then ends. However, some providers are prepared to continue the cover for a limited period, provided a Swiss correspondence address can be provided.

Summary:

It is essential to check the insurance cover for unpaid leave! Imagine you have an accident abroad. This incurs high evacuation and medical costs and afterwards you are no longer able to work and are disabled for life. With no or inadequate insurance cover. A horror scenario!

Employers should draw up a leaflet on the subject of unpaid leave for HR and the employee so that the wheel doesn't have to be reinvented every time.

New Allianz Care product

Allianz announces a new IPMI product for the Swiss market (group solution for medium-sized and larger customers domiciled in Switzerland). This solution will be offered in addition to the existing KVG-coordinated Swiss plans (KPT and stand alone plans) and is aimed at customers with a mixed insured structure (with and without KVG obligation). The product will be launched in mid-March and we are looking forward to the details. We will keep you informed.

Globality S.A. becomes Foyer Global Health S.A.

Following the takeover of Globality Health S.A. by the Foyer Group in 2023, the company name has now also been changed to Foyer Global Health S.A. with registered office at 12, rue Léon Laval, L-3372 Leudelange, Luxembourg, as of 29 February 2024.

This adjustment does not result in any changes to the insurance contracts and obligations to customers. As previously announced, the partnership with SWICA will continue unchanged.

IPMI (International Private Medical Insurance) - Increase in medical costs

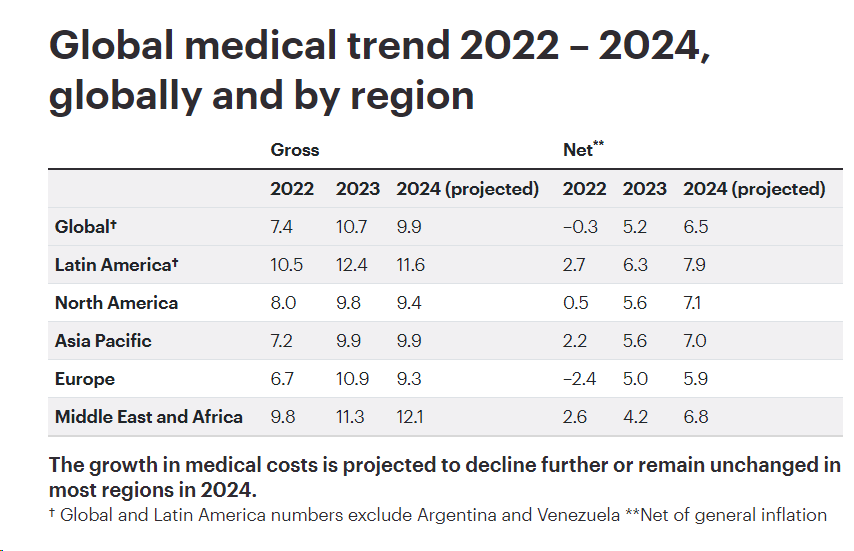

The trend towards cost growth continues. In addition to the usual cost drivers, "normal" inflation is a decisive factor. Assuming that inflation rates worldwide will fall slightly on average in 2024, the gross cost increase is also likely to slow down slightly compared to the previous year - albeit at a high level! And net cost increases will continue to rise. This will in turn be reflected in insurance premiums. These will probably rise at the almost usual rate.

Source: WTW, 2024 Global Medical Trend Report